AUSTIN, Texas — As millions of Americans are filing for unemployment, the Internal Revenue Service (IRS) is giving us new information about how the CARES Act economic impact payments will be sent out.

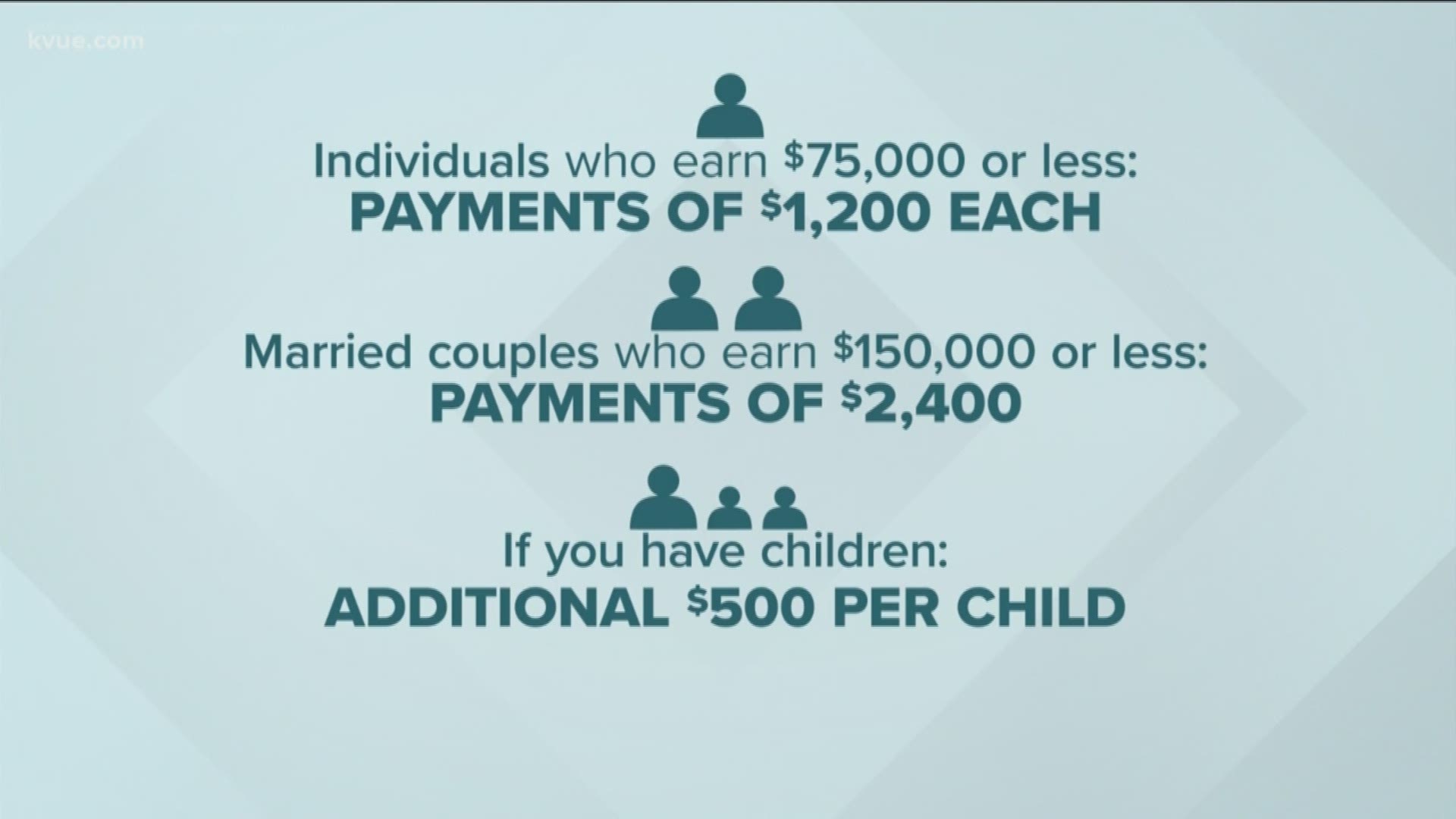

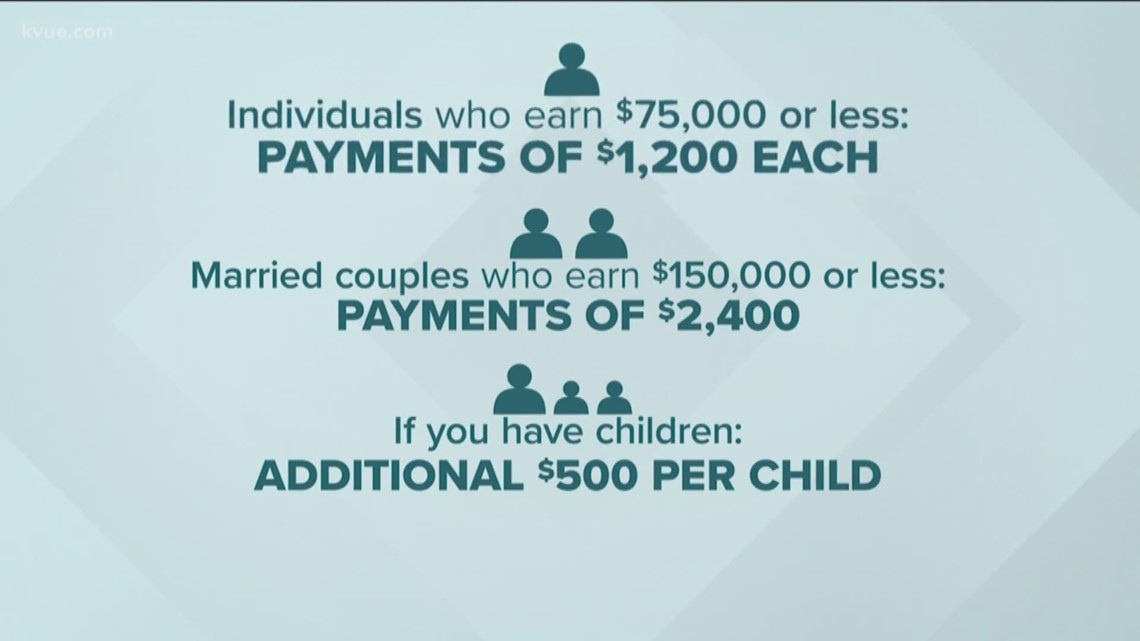

Individuals who earn $75,000 or less and couples who make $150,000 or less will receive full payments plus an extra $500 per child.

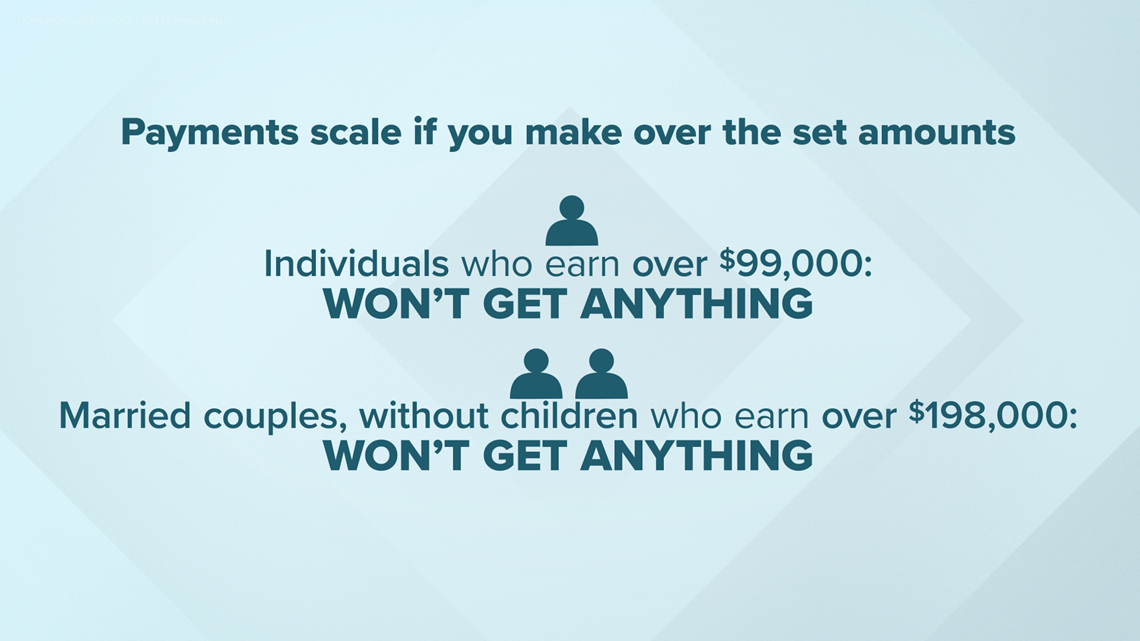

According to the IRS, the payment amount will decrease by $5 for every $100 that's above the earning threshold.

And individuals who make more than $99,000 and couples without children who earn more than $198,000 together won't get anything at all.

The IRS will use tax return filings for 2019 to send out the payment. If you haven't filed for 2019, the agency will use 2018 data. People who haven't filed their taxes for either year should do so as soon as possible to get a payment.

People who get their refunds through direct deposit won't have to do anything at all to receive their economic impact payment. If you don't, the IRS announced Thursday that it's creating a new, secure portal for people to input their banking information. It will be available on IRS.gov until mid-April. People who don't submit their information will receive their economic payment through a mailed check.

But what about people who don't file a tax return, like senior citizens, social security recipients and railroad retirees?

RELATED:

Wednesday night, the U.S. Department of Treasury announced social security recipients won't have to do anything to receive a payment. It will automatically be deposited into your account.

The IRS will use information from the Form SSA-1099 or Form RRB-1099 to get payments to those other groups.

Thursday, the IRS warned scammers are now trying to take advantage of people. IRS agents will not call, text or email people about their economic impact payments. The IRS also said anyone offering a service to get you a payment faster is a scammer.

Agents said one tell-tale sign that someone is a scammer is that they will refer to the payment as a "stimulus." That's not the official name of the payments authorized by the CARES Act and IRS agents won't ever call it that.

PEOPLE ARE ALSO READING: