AUSTIN -- The campaign to convince Texans to vote "Yes" on a measure to lower property taxes launched Thursday morning in Austin.

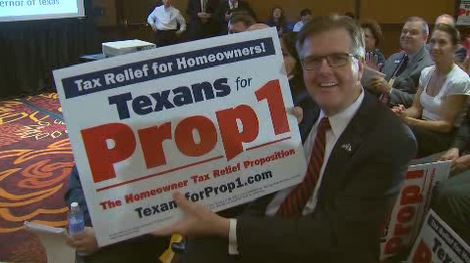

With all the excitement of a campaign rally, Lt. Gov. Dan Patrick joined a gathering of Texas realtors to pump up enthusiasm for Proposition 1 on the statewide ballot. The measure will go before voters in November as the final realization of one of Patrick's campaign promises.

"It's the beginning of long-term property tax relief," Patrick said to roaring applause from the annual convention of the Texas Association of Realtors. Patrick explained to KVUE afterward, "It will forever eliminate the possibility of a tax when you sell your property."

"Right now we're in a surplus, but if we're not in a surplus, they look for money, and a lot of states tax for real estate," said Texas Association of Realtors chairman Scott Kesner.

The cost of Proposition 1 -- more than $600 million a year of state taxpayer funds -- would be to offset money that would otherwise be lost by school districts after raising the homestead exemption by another $10,000 to $25,000. It's estimated to save the average homeowner around $126 a year.

During the session, some lawmakers questioned whether the relief would be noticeable enough to the average taxpayer to justify the expense. A report by the Texas House Ways and Means Committee predicted many homeowners would see taxes increase regardless.

"That's why this is step one," Patrick said of the concern. "Make no mistake, and for all those legislators who said it wasn't big enough, they're the ones who cut it in half, actually."

Proposition 1 made it to the ballot only after hard-fought budget negotiations with the House, which trimmed down the final package. The final votes were overwhelmingly in favor of the measure to authorize the constitutional amendment election.

In a forthcoming policy brief from the Center for Public Policy Priorities set to be released Oct. 12, senior fiscal analyst Dick Lavine notes the change would simply replace lost local revenue to school districts with general revenue.

"The Legislature should not have prioritized cutting taxes over making the investments necessary to ensure a Texas where everyone is healthy, well-educated, and financially secure," said Lavine.

"You tell any person out there that they don't want an extra $150 or so in their pocket tax relief that will be lasting. They will always have this increased home exemption," Patrick said. "Sometimes not every legislator gets the message, but homeowners have delivered the message. They want property tax relief."

Patrick said the next step would be to reduce the increase in tax every year based on values, another proposition that faced significant difficulty during the session. Nonetheless, Thursday represented a victory for the first-term lieutenant governor, who took another lap Thursday morning. Soon voters will make the final call.