AUSTIN, Texas — In Austin’s booming economy, property ownership certainly has its perks, like paying less in taxes on the place you actually call home. This is called the homestead exemption.

But when a property owner falsely claims a homestead exemption on a rental home they don’t live in and make money from, we all lose out.

The Travis Central Appraisal District (TCAD) said that tax exemptions on short-term rental properties are hard to police.

If you were to ask Army veteran Michelle Thomas a year ago what she would be doing now, she likely wouldn’t say “detective” work.

“I took pictures of the entire cottage,” said Thomas.

This short-term rental cottage led to a lawsuit and questions so big she called KVUE for help.

“There are three different properties on this one lot,” said Thomas.

It all started with a broken door and an argument with her landlords.

RELATED: Austin leaders to discuss 2019 budget plan that could increase energy bills, property taxes

She rented a house in Clarksville near Downtown Austin. Thomas wrote an online review.

“A one-star online review while I was still living there,” said Thomas.

She said within a week, a “request for retraction” letter showed up in her mailbox from the landlords’ attorney.

“[The retraction was] telling me to delete the review and requesting that I pay damage to a door,” said Thomas.

She said she hired a professional to fix the door. The landlords, Brian Stansberry and Phillip Risinger, later sued Thomas.

“This is the condition that I left the door,” said Thomas pointing to a photo of a red door.

She said she didn’t have the money for an attorney.

“I decided to represent myself, which I would not recommend to anyone,” said Thomas.

She then started her “detective” work.

Looking for a place to serve papers, she found “they were homesteading [a different property] that I had once before rented.”

A homestead exemption limits the amount of taxable value on the home you live in. Bottom line, it saves homeowners money.

Homestead exemptions cannot be used for permanent rental properties.

The KVUE Defenders asked if reporting the homestead designation was out of revenge.

“No. This is something I discovered through the course of the lawsuit … I want answers as to is this legal,” said Thomas.

No. It’s not legal.

At the bottom of the Travis Central Appraisal District homestead exemption form at point “three” between your name and signature, it says you cannot “claim an exemption on another residence homestead or claim a residence homestead exemption on a residence homestead outside Texas.” Making a false statement on the form can be a Class A misdemeanor or a state jail felony under Penal Code Section 37.10.

A tenant we spoke with said the three homes are all rentals.

When we reached out to property owners, Stansberry called us back but refused to give an on-camera interview.

“We take that very seriously,” said Lonnie Hendry, deputy chief appraiser for TCAD.

It's his job to make sure property owners don’t skirt the law. Hendry said we all pay if someone has homestead status when they shouldn’t.

“It disproportionally affects everyone else,” said Hendry.

Records show Stansberry and Risinger had homestead designations on the three homes in Austin, which are all on one property.

“The property owner has been claiming the homestead on multiple properties,” said Hendry.

Stansberry also holds two more homestead designations in Washington, D.C., according to property records.

KVUE asked TCAD if they need more manpower.

“That’s one of the challenges,” said Hendry.

Appraisal districts rely on tips from neighbors or people like Thomas.

“There is no central repository database,” said Hendry.

KVUE pulled data showing Austin’s short-term rental permits and found more questionable homestead exempted properties.

For Austin’s “type 2 rentals,” the owners admit they live somewhere else. Yet KUVE questioned if others are getting the homestead tax break and if TCAD can compare Austin’s short-term rental data with their property records.

“I think that’s something we’re definitely going to look into,” said Hendry.

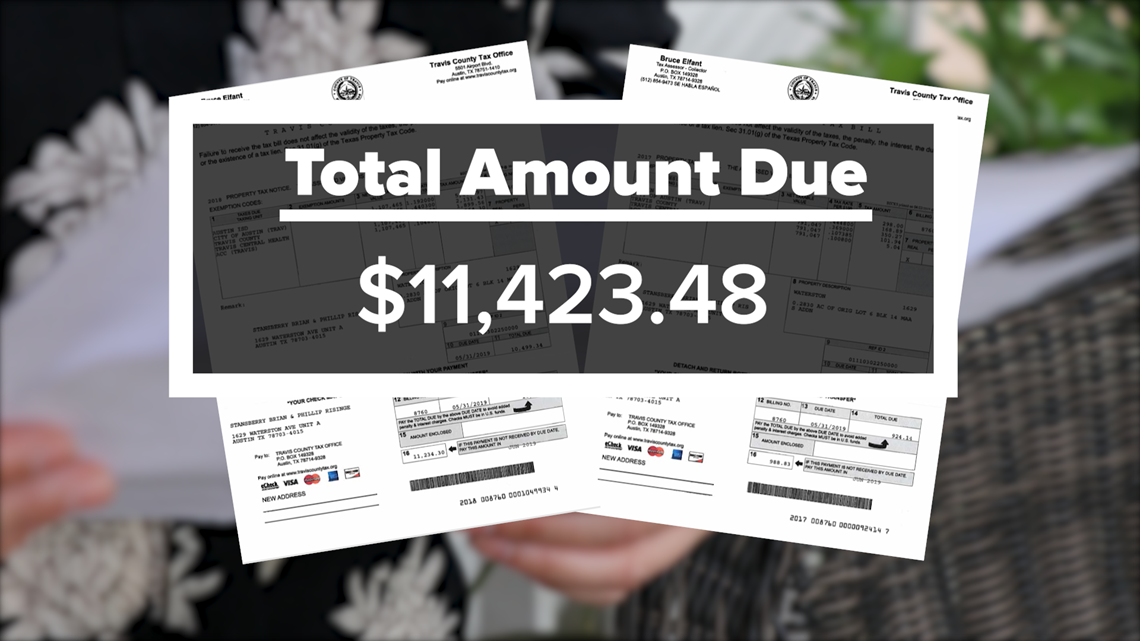

TCAD referred this case to the Travis County District Attorney. The tax office sent Stansberry and Risinger bills totaling $11,423.48 in property taxes owed.

“Wow,” said Thomas. “It’s good for Travis County. That’s an incredible difference.”

During our investigation, TCAD removed the homestead exemption.

Stansberry and Risinger registered the Clarksville rental property as a “type one,” which is listed as an owner-occupied short-term rental in the city of Austin.

Austin Code enforcement is investigating. As far as those other properties mentioned, TCAD is looking into those now as well.

Hendry said most unqualified homestead exemptions are accidents, like when someone inherits a property and doesn’t change the exemption.

PEOPLE ARE ALSO READING: