TRAVIS COUNTY, Texas — Our tax dollars pay for the government and community services we all need and enjoy, including law enforcement, fire, EMS, utilities, roads and parks.

When property owners don't pay, it's our children in public schools who miss out the most.

This big home has a big problem: its property tax debt. The uncollected debt was "deferred" for more than a decade. ...

Down its own private driveway, on more than two-and-a-half acres, a Sunset Valley home links to one of the largest tax bills in Travis County. The property tax bill is $313,606.07. It was left uncollected, dating back to 2003.

The owner, Lelah Kleas, died July 2014. Until her death, the property tax was listed as “deferred,” left building a debt for her heirs. The county learned of the death in 2016 and started its debt collection process.

“Probate can be pretty complicated,” said Bruce Elfant, Travis County Tax Assessor-Collector.

Travis County filed a lawsuit to collect.

“I'm personally responsible for collecting property taxes,” said Elfant. “We want to do it as compassionately as we can and we want to work with people as much as the law will allow us, but at the end of the day, our job is to collect property taxes.”

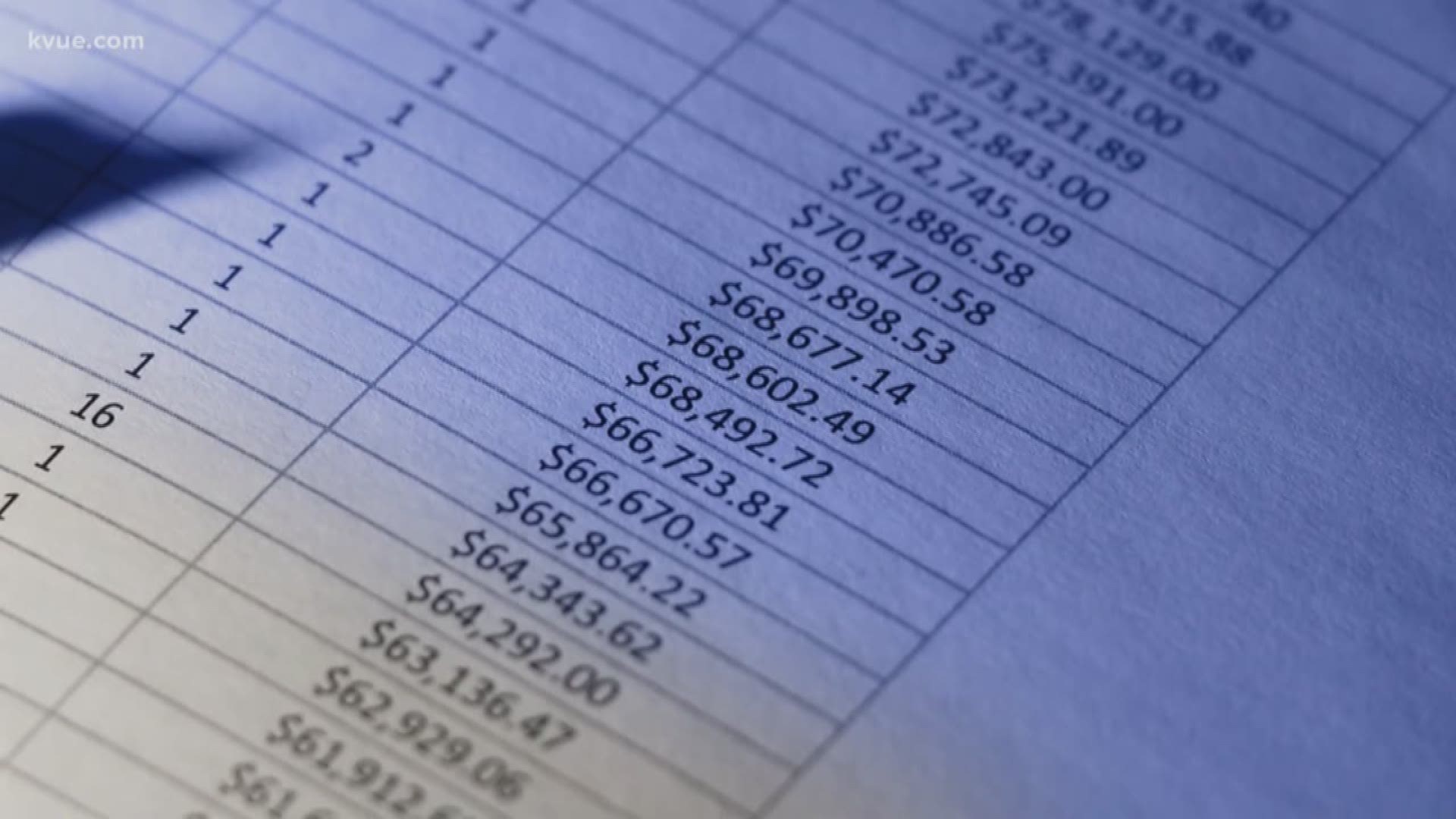

KVUE Defenders found more than $43,632,428.94 in property taxes owed by 7,247 delinquent Travis County properties for businesses and homeowners.

Of those, 3,218 will eventually pay, but maybe years down the road. The accounts show either deferred, under a payment plan, court appeal or bankruptcy.

The owners of IO at Tech Ridge owed more than $192.327.80 in property taxes when they filed bankruptcy in December.

“If they are in bankruptcy, we are not able to take action,” said Elfant.

We told you in May, the property sold in a private bidding process. The money from the sale will pay the tax debt.

If a property isn't involved in a lawsuit or bankruptcy, the county can move to foreclose. If that happens, the unpaid property tax bill sits there, meaning the county doesn't get its money unless somebody buys it.

The KVUE Defenders found hundreds of old foreclosures, utility easements and park space acquired by either Travis County, the City of Austin, or the State of Texas.

Unless the government groups sell the property, the tax can stay uncollected for years.

“All of our properties that are in inventory are online and people can decide a bid on them … our interest is to get them sold and get them back on the tax rolls,” said Elfant.

Click here to see the resale list.

Much of the outstanding debt trickles down to our children. More than half would go to local school districts, $25,569,288 if all debts got paid.

“I don't care who they are, they have to put their fair share … our kids depend on it,” said Ken Zarifis, president of Education Austin.

Education Austin is a labor union for Austin school teachers and employees. He fights to get more funding for public schools.

“Right now, we are in the middle of a $30 million deficit. That does a lot to shore up our budget. It means a lot to our kids,” said Zarifis.

While the uncollected money adds up to the millions, Bruce Elfant is proud of his office's collection rate.

“Our tax collection rate is at 99.2 percent, and by the time we finish this fiscal year will probably be at 99.7 percent, which is one of the highest in the major urban counties,” he said.

If you don't pay your property tax, the interest can go up to 24 percent.

The county urges you to get on a payment plan as soon as possible.

The tax rates for your next bill will be set in a couple of months.

If you want more information on how to pay your property tax bill in Travis County, click here.

If you have a story idea for the Defenders, email us defenders@kvue.com

Follow Erica Proffer on Twitter @ericaproffer, Facebook @ericaprofferjournalist, and Instagram @ericaproffer.