AUSTIN, Texas — As the Jan. 31 property tax deadline approaches for Texas homeowners, there's a change to the homestead exemption law that many don't know about.

It took effect on Jan. 1. It saves most homeowners money but, for those buying a brand new construction, it may not be worth taking it.

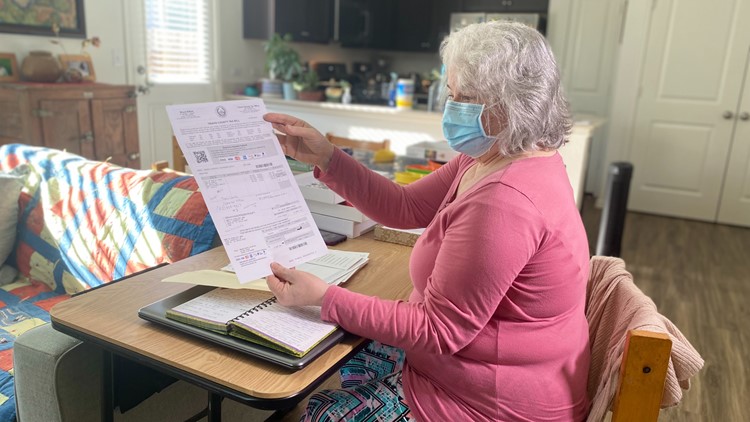

Retired Austin teacher Penny Martin found that out the hard way. She contacted the KVUE Defenders for help. And while the change does not affect her, she wants others to know about it.

She discovered it while trying to get help with her complex situation. Martin found her current home when it was brand-new and unconstructed in the Colorado Crossing neighborhood in South Austin back in 2020, closed on it at the beginning of 2021 but didn't move into it until March of that year when it was finished being built.

She said that's around the time she started calling the Travis Central Appraisal District to ask about transferring the homestead and over-65 exemptions from her previous home to the new one. In the process, Martin discovered a change in a state law she said very few people know about. She was concerned it could cost people who can't afford it, even more money.

"Then people need to know about this because they don't know," Martin said.

A homestead exemption removes part of your home's value from being taxed, so it lowers your property taxes. The change is great for homeowners whose houses are not under construction.

Julia Null is a partner with Clayton and Ramirez, a law firm that specializes in real estate, estate planning and probate.

"For the very first time, if you move into a property or purchase a property after Jan. 1, you now might be eligible to go ahead and get that homestead exemption," Null said.

Before, you had to wait until the following year to apply for that exemption. But, for new builds, Null said this is where it gets tricky.

"The issue when we are dealing with this new tax law is that it's going to be really difficult for people who are buying new homes because if that home was not 100% built by Jan. 1, then it wouldn't qualify for a homestead exemption as of Jan. 1 because it cannot have someone that lives in it. It's not qualified, probably can't get a CO, a certificate of occupancy," Null said.

Null also said she plans to keep a close eye on something else.

"What I'm really curious to see what's going to happen is the protests and arguments are going to happen in terms of the house was at completion for livability, but maybe not completion for the final transaction. And what I mean by that is you can get a certificate of occupancy if you maybe have one working toilet in the house, but you don't have them all in, well, you're not going to move into that house where it's not completely finished, but it could be livable," Null said.

Martin eventually worked out a solution with TCAD: no homestead or over-65 exemptions for 2021 but will get both for 2022.

Brooke Steele is Martin's Realtor and helped her through the TCAD process. She is with Realty Austin.

"They appraised it as just half-finished, so half the value. So, to her benefit, it was better for her to take that amount, the lower appraisal amount of half of the home and have that as her tax bill, which was much lower than a full value of a home," Steele said.

In other words, Martin is paying less in taxes for 2021 – a lesson she hopes others learn faster than she did.

We made several requests with the Travis Central Appraisal District for an on-camera interview. No reason was given for declining those requests.

PEOPLE ARE ALSO READING: