AUSTIN, Texas — School districts have two ways to use your property tax dollars: Maintenance and Operation (M&O) and Interest and Sinking (I&S).

M&O pays for day-to-day functions to keep a school running, including salaries and transportation. I&S covers bond debts for financing district facilities.

Gov. Greg Abbott wants to eliminate the M&O completely.

“How should we approach it? In the typical Texas fashion – we must go big. We must dream big. Dream of the possibility that we can eliminate property taxes in Texas,” Abbott said during a recent fireside chat with Texas Public Policy Foundation (TPFF).

Would that mean your school property tax rate would go to zero? Not exactly.

The TPPF plan shows that it would take 10 years to get to zero on the M&O tax bill. It would start with a 30% tax rate cut, which would also be for both commercial and residential.

However, even if the M&O rate went to zero, the I&S would remain on the property tax bill. It is a tax voters approved during a bond election.

Here’s what a zero M&O rate looks like for the three largest school systems in our area, using the median home price for our area of $466,704, according to the Texas Real Estate Research Center at Texas A&M University.

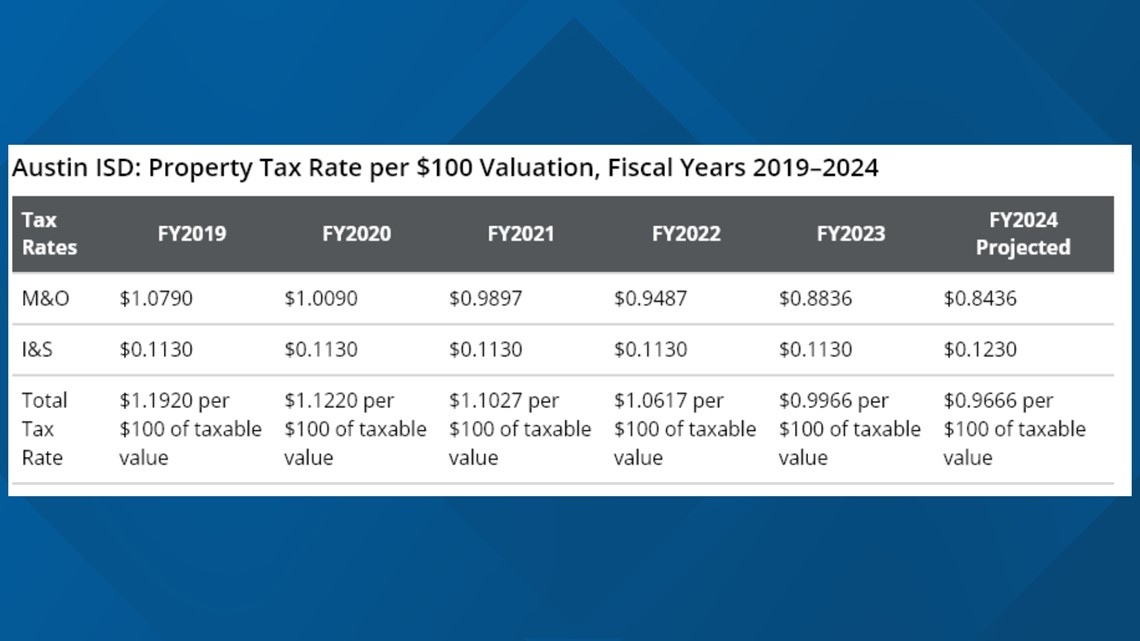

For Austin ISD, the current tax rate and no exemptions show $4,651. That’s for M&O as well as the I&S bond money.

The bill would be $527 without the M&O.

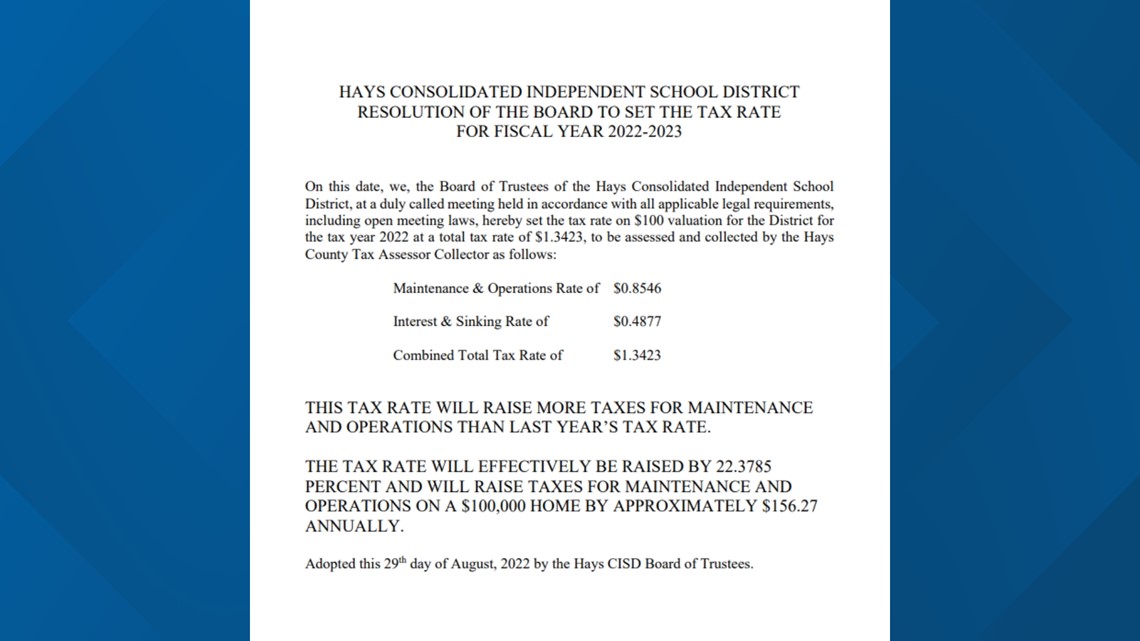

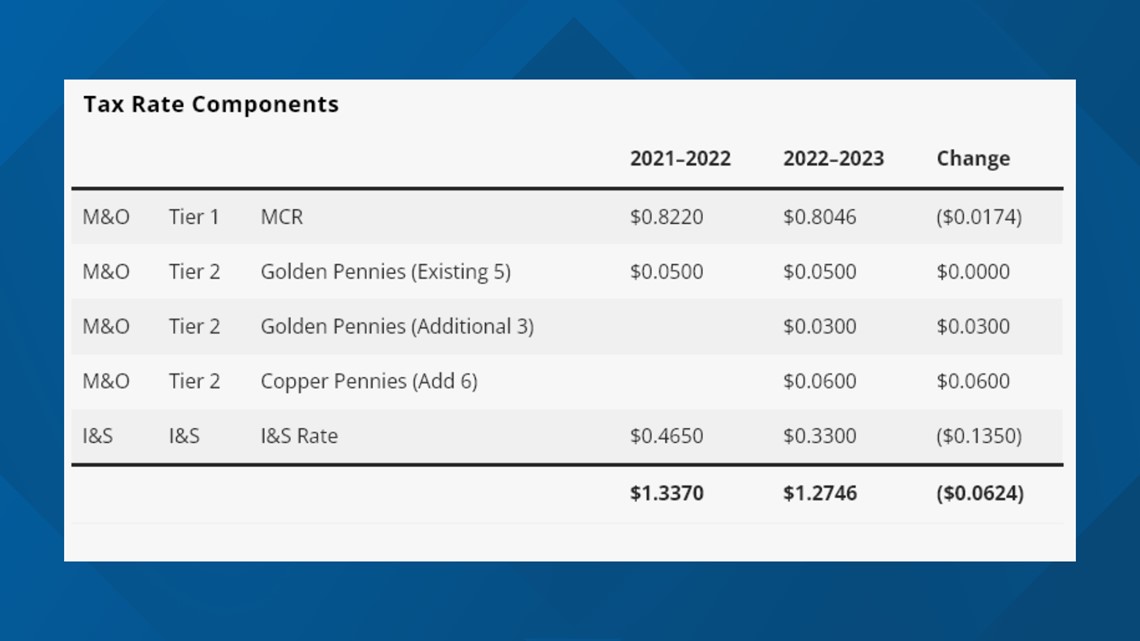

For Hays CISD, instead of a little more than $6,264 in school taxes for this median home, it would be $2,276.

Leander ISD’s current tax bill would go from $5,949 with M&O to $1,540 without the M&O.

Lt. Gov. Dan Patrick wants to lower the M&O but not to zero. Instead, he wants to raise homestead exemption to $100,000.

That would give homeowners a bigger tax break on the property where they live without giving the same break to commercial and investment properties.

“When I come to the table to negotiate, I bring numbers, data, facts," Patrick said. "I don’t walk in and say, 'This is a good idea.'"