AUSTIN, Texas — Even if you had no increase on your property value, the bill could still increase.

Taxing entities, like cities and school districts, determine how much to charge. In Travis County, more money goes to Austin ISD than any other taxing entity in the county at $1.5 billion.

One homeowner may pay five or more taxing entities including city, county, school district, health district and community college district.

One way for property value to increase but keep the tax bill the same would be for taxing entities to lower what they charge.

In 2021, school districts in Travis county lowered their rates. Homeowners would pay less, unless the property value increased by more than the savings.

Some cities, like Leander, also lowered rates. The City of Austin did not.

Austin raised the property tax rate from $0.5335 per $100 taxable value in 2020 to $0.541 in 2021.

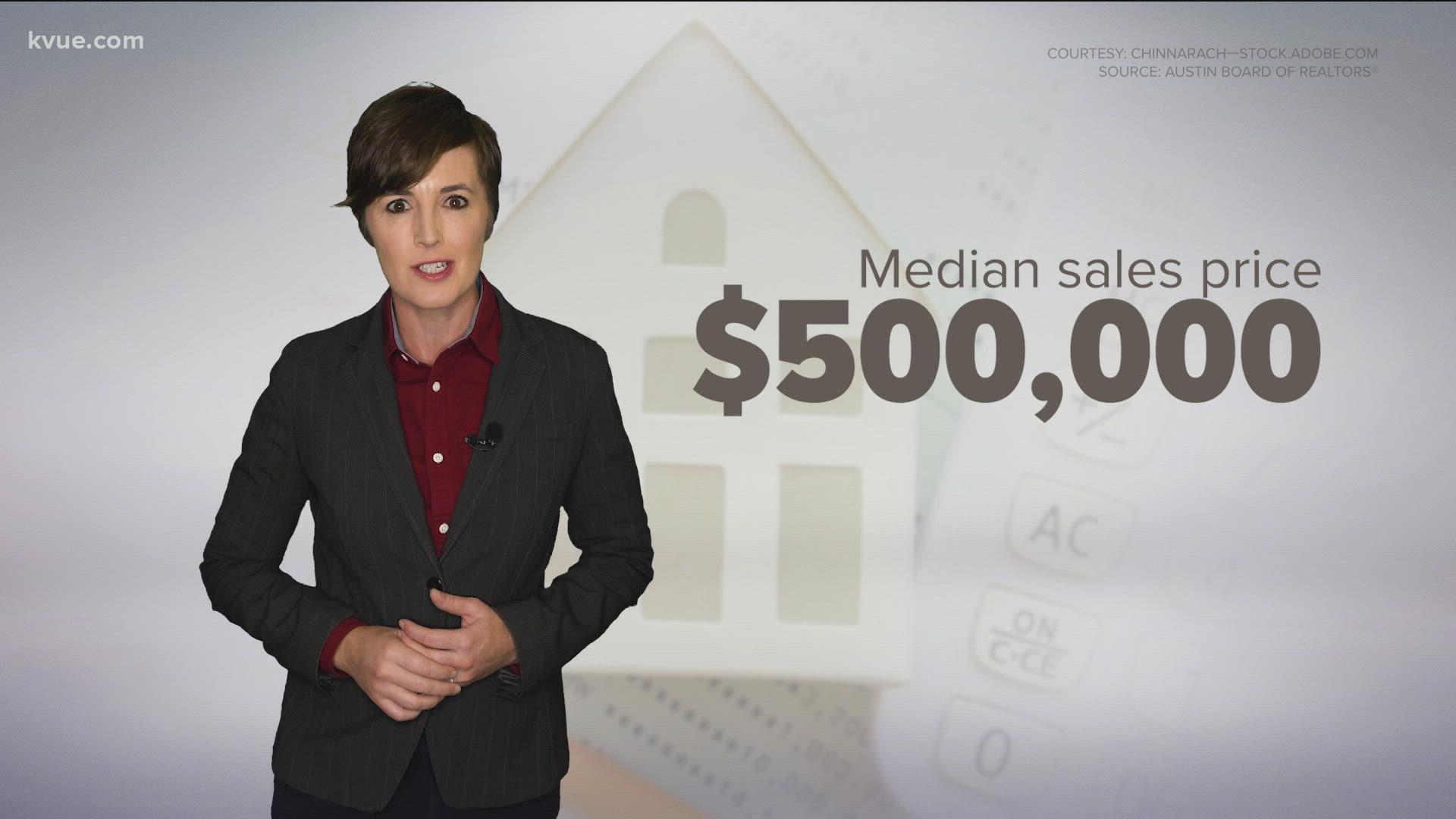

That would be an additional $38 on a $500,000 home.

How to save money:

Homeowners can save money through exemptions. The most used exemption is homestead.

Travis County homestead exemptions include:

- General Residence Homestead Exemption

- Person age 65 or older (or surviving spouse)

- Disabled person (or surviving spouse)

- 100% disabled veteran (or surviving spouse)

- Disabled veteran or survivor

- Donated residence of partially disabled veteran (or surviving spouse)

- Surviving spouse of an armed services member killed in action

- Surviving spouse of a first responder killed in the line of duty

The Tax Code also allows for a chief appraiser to determine if a property qualifies for a temporary exemption if that property has been damaged. Also, property owners have until April 30 to apply for an exemption for certain solar and wind-powered energy units.

The Texas Constitution requires local taxing entities to let the public know about tax proposals in order to get public input. Travis County and Williamson County both have a website for people to search for their address and see the tax breakdown by each entity.

The other way to save is to participate in public budget hearings. Voters can pressure taxing entities to lower rates and cut costs.

The KVUE Defenders pulled records for which businesses get property tax breaks.

The City of Austin’s data portal shows 25 agreements with the City. Eight businesses are listed under Travis County’s Economic Development Incentive Agreements.

These agreements are based on what the company can provide to the area. An agreement may include a minimum amount of full-time jobs, minimum pay rate and dedicated construction investment.

For example, Tesla’s “Colorado River Project” agreement shows the company will invest more than $1 billion in initial construction, hire more than 5,000 full-time workers with pay starting at no less than $15/hour, offer paid time off, and use reclaimed water.

The company must also invest at least 10% of the Operation and Maintenance (O&M) Ad Valorem Property Tax owed into community programs, such as supporting affordable housing and extending public transit.

In exchange, the county grants 70% of Tesla’s O&M ad valorem taxes paid for 20 years for up to $1 billion investment. After that, the incentive increases to 75% for $1-2 billion investment and 80% for more than $2 billion investment.

Travis County will not offer more incentives until a new policy is written.

“In July of 2019, the Court approved a moratorium on new applications under this program in order to make updates to the policy,” the County’s website shows.

The moratorium was lifted for Tesla and Samsung, which is under negotiation.

Property tax protests end May 15.

PEOPLE ARE ALSO READING: