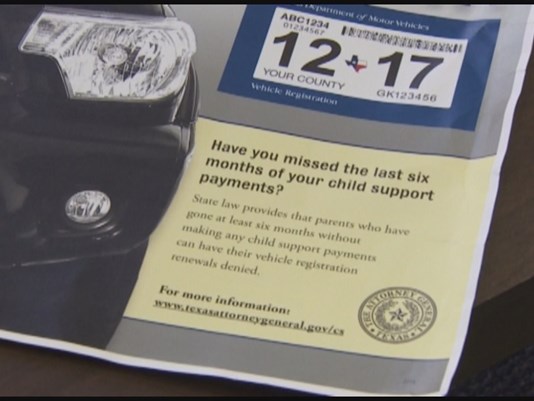

If you're one of the thousands of Texans that owes child support, you might want to pay attention and pay up. Beginning in December, not paying will impact your ability to renew your car registration.

The new policy is simple -- if you missed paying child support for six straight months, you're going to have to start paying again before you can renew. The new policy will be enforced starting in December, but Texans can expect to learn about the potential roadblock beginning in September in their standard three-month renewal notice.

The policy may be simple, but implementation, not so much. Tax assessor-collectors across Texas are concerned about this policy's impact on their office. That includes Harris County Tax Assessor-Collector Mike Sullivan.

"Any disruption will slow down traffic, it will make lines longer, there's always the possibility of confrontation, because there's a lot of emotion when children are involved," said Sullivan.

Sullivan said his office has received little to no training from the Texas Attorney General's office. He worries his employees will receive the brunt of the blame when the computer system forces them to deny registrations.

The AG's office says this will effect about 1,000 to 2,000 parents across Texas each month.

Family law attorney Cheryl Alsandor worries this is a huge problem waiting to happen.

"They don't have the ability to check child support payment history," said Alsandor. "Yet they're going to deal with disgruntled citizens who want to renew their registration," said Alsandor.

Sullivan fears this policy won't make people pay up more child support, but rather force more people not to renew their registrations.

"Law enforcement will be dealing with this as well," said Sullivan. "If you stop a vehicle that has an expired registration and that driver tells you that they couldn't get it because they couldn't pay their child support, that's going to be a tough discussion on the side of the road in the middle of the night."

Below is the Texas AG's office full statement:

"The OAG’s Child Support Division uses every available means to gain compliance with court orders and get lawfully obligated money to children. Because of the Texas program’s multifaceted approach, it is first among 54 states, territories and districts for the amount of child support collected; the amount of child support collected per employee; and cost effectiveness.

Our office has worked closely with tax assessor-collectors across the state to make the new process as seamless as possible. We appreciate the role these officials will play in helping children in their communities receive the financial support they are due.

It is not the desire of the OAG to take away a parent's transportation; it is our desire to see that Texas children receive court ordered child support."