AUSTIN, Texas — According to the United States Treasury, 80 million Americans will receive COVID-19 relief payments by Wednesday, April 15 – but debt collectors could get your money first.

Twenty-five state attorneys general and the Hawaii Office of Consumer Protection sent a letter to Treasury Secretary Steven Mnuchin on Monday, asking him to use his authority to set a rule to stop that from happening.

Last month, Congress passed the CARES Act, which includes one-time payments of $1,200 to individuals who earn $75,000 a year or less and $2,400 to couples who make $150,000 or less, with less money for people who earn more.

RELATED:

But the bill doesn't state the payments are exempt from garnishments, including money owed to your bank or creditors.

Congress did include a safety net in the bill to allow the Treasury Department the authority to make additional rules regarding the payments, which is why some states are asking the department to step in. Texas isn't one of the states asking for this action.

KVUE reached out to the Treasury Department for comment but as of Wednesday evening had not heard back.

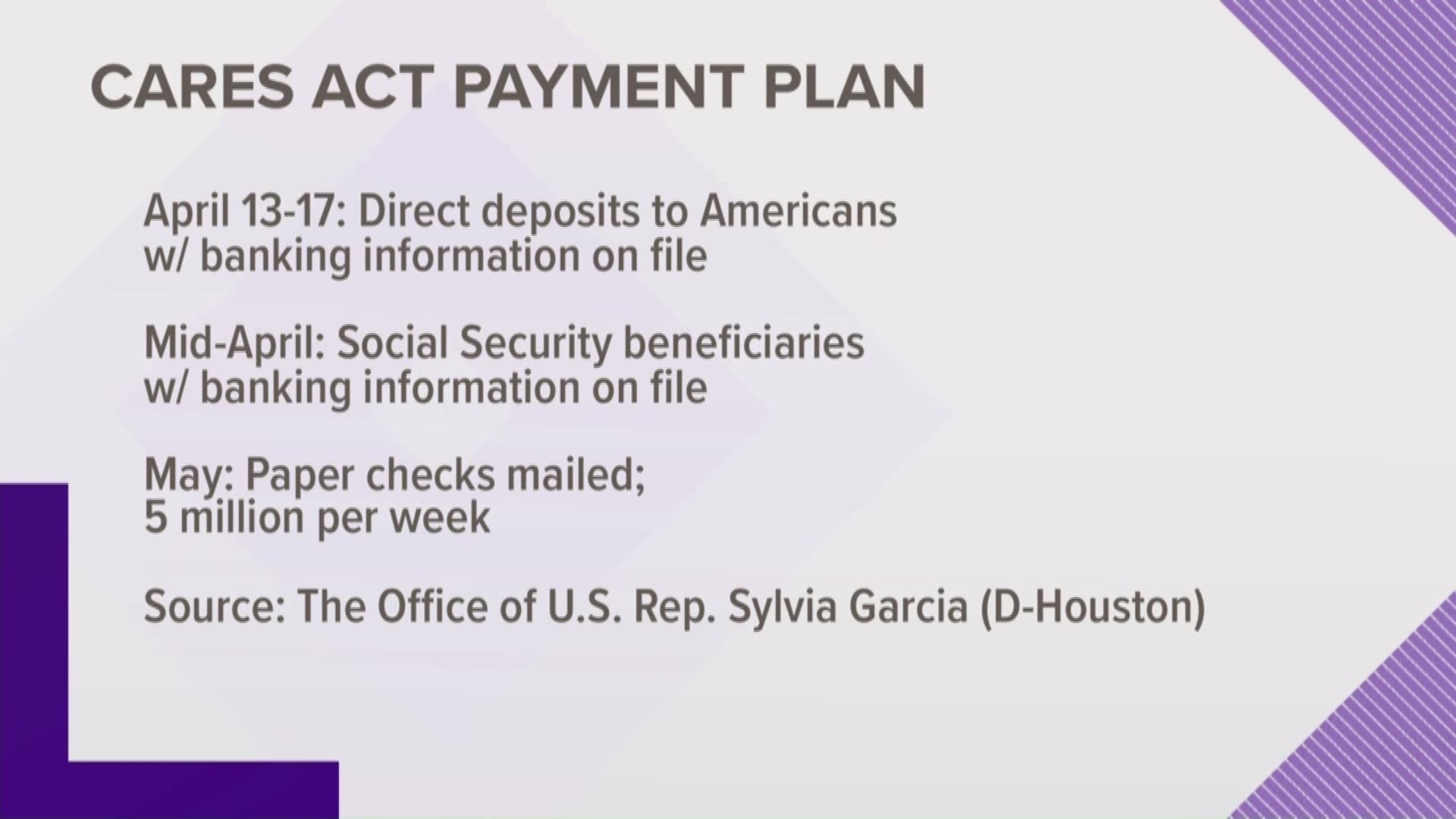

When it comes to how the payments will be distributed, Texas Congresswoman Sylvia Garcia (D-Houston) released a timeline for payments. According to her office, the first round of payments – which some people have already received – will go to people who received their 2018 or 2019 tax refunds through direct deposit.

The next round of payments will happen later in April and will be made to people on Social Security who don't have to file taxes but get direct deposits from the government.

Starting the first week of May, the IRS will start issuing paper checks to people at a rate of 5 million checks per week, starting with people who make the lowest incomes first. It's estimated it could take up to 20 weeks to get all the paper checks out.

Regardless of how you get your payment, the IRS will mail letters about two weeks after a payment is sent. And this week, the IRS is launching an online app that will allow people to track their payments and provide banking information to get a direct deposit if their information isn't already on file.

People who don't have to file taxes due to income restrictions can submit their banking information to the IRS.

MORE CORONAVIRUS COVERAGE:

- Total Men's Primary Care rolls out coronavirus antibody testing; tests not approved by FDA

- You asked, we got answers: COVID-19 and unemployment questions

- LIST: Confirmed Central Texas coronavirus cases by county

- Travis County commissioners approve hiring freeze for county employees to ease financial burden from COVID-19

- Torchy's Tacos one of several restaurants launching 'Come and Takeout' campaign

- As business for tenant lawyers ramps up, Austin residents are worried about paying rent